Investing for Health-Care Professionals

After a long stretch of relative stability, the U.S. economy hit a rough patch in 2022-2023. Inflation and interest rates reached levels not seen in decades, and even though both have started to subside, many Americans feel pessimistic.

What do these circumstances mean for medical professionals? During my 39 years as an investment adviser, I have worked with dozens of physicians and other health care professionals.

The first financial rule is to use your 401(k) or, if you work for a non-profit, your 403(b). You want to put away the limit every year. This is money you are not going to touch for decades. It will absolutely compound over time - especially if you are young. After you retire, you will also have some control over how fast to take it out and when tax-wise.

My general advice is to be more aggressive than your comfort level. So, if you are comfortable with a 40 percent stock portfolio, it probably ought to be 50 percent. If you are comfortable with 50 percent, it would probably be better off at 60 percent.

Most people are more risk-averse than necessary. The averages tend to be in your favor if you are more aggressive. So, I often push people to the edge because I know they will be rewarded eventually. The more growth assets, the more you will have for retirement.

Do not let up as you age. That was the norm in the past, but people live much longer today. It used to be retired people lived seven or ten more years. Now if there are spouses doing well into their sixties, chances are one of them will live another 30 years. With that time span, you need to continue with aggressive savings and investments.

Debt can be an issue. I would pay down the highest-costing debt first. That might be credit cards, it might be student loans.

The wild card is President Biden keeps talking about reducing or eliminating student debt. So, I would be reluctant to pay it off faster than necessary right now. You would feel awful about paying it off, and then the next week, they come in and forgive everyone’s debt.

Inflation affects both income and savings. We have had decades of low inflation, so many people have never experienced higher. Even 2 percent to 3 percent inflation over 10 years makes a dramatic difference in purchasing power.

In recent years, savers have been getting almost nothing in money held in bonds or certificates of deposit. That has ticked up now. Some money market funds are paying over 4 percent, and some are even bumping up into the fives. If you have money sitting in a bank account and it is not earning anything, get invested somewhere where you can earn a safe 4 percent or 5 percent annually.

Resist the temptation to splurge. Professionals - especially in health care disciplines - do not earn much when they are going through school. When they finally graduate, they make what seems like a lot to them, so there is a temptation to splurge.

Whatever their income is today, it is likely to rise due to experience and inflation. So instead of thinking, “I’m making $300,000 this year, and I know next year I’m going to make $350,000, so I’m going to buy the car I want and the cabin on the lake,” I tell them to wait until they are at that point before buying.

Sometimes, a doctor who has been living frugally sees a big salary number, and it seems almost inexhaustible. And I tell them that it is exhaustible, but if they wait a while, they will be able to do everything they want.

Americans make bad spending decisions. We spend money on stuff that doesn’t maintain value. You buy that sparkling new car, and two days later, it is worth $25,000 less. Good decisions make a stark difference in how you fare over time.

Much of this is just research. It used to be that financial advisers knew stuff nobody else knew; that is not so true anymore. I doubt I know anything that you could not find out yourself. But the value of a good adviser is that you do not have to study it yourself. I also think a lot of people think they are doing a decent job with investing and finance, but they don’t know what they don’t know.

I can read up on medical stuff, but there is a real value in my sitting down with my physician, who helps me understand and apply things to my own circumstances. And that is what a good financial adviser does. There is genuine value in an ongoing professional relationship.

Dan Danford, CFP®

Family Investment Center

Founder and Chairman of the Board

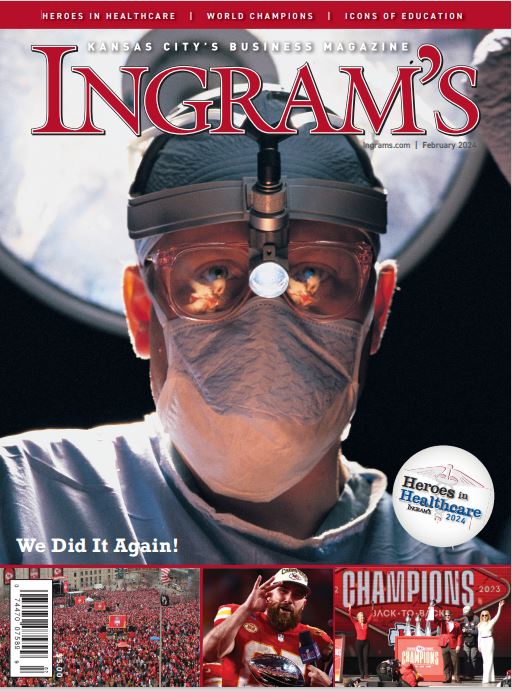

As published in Ingram's February 2024 issue on 2/23/2024