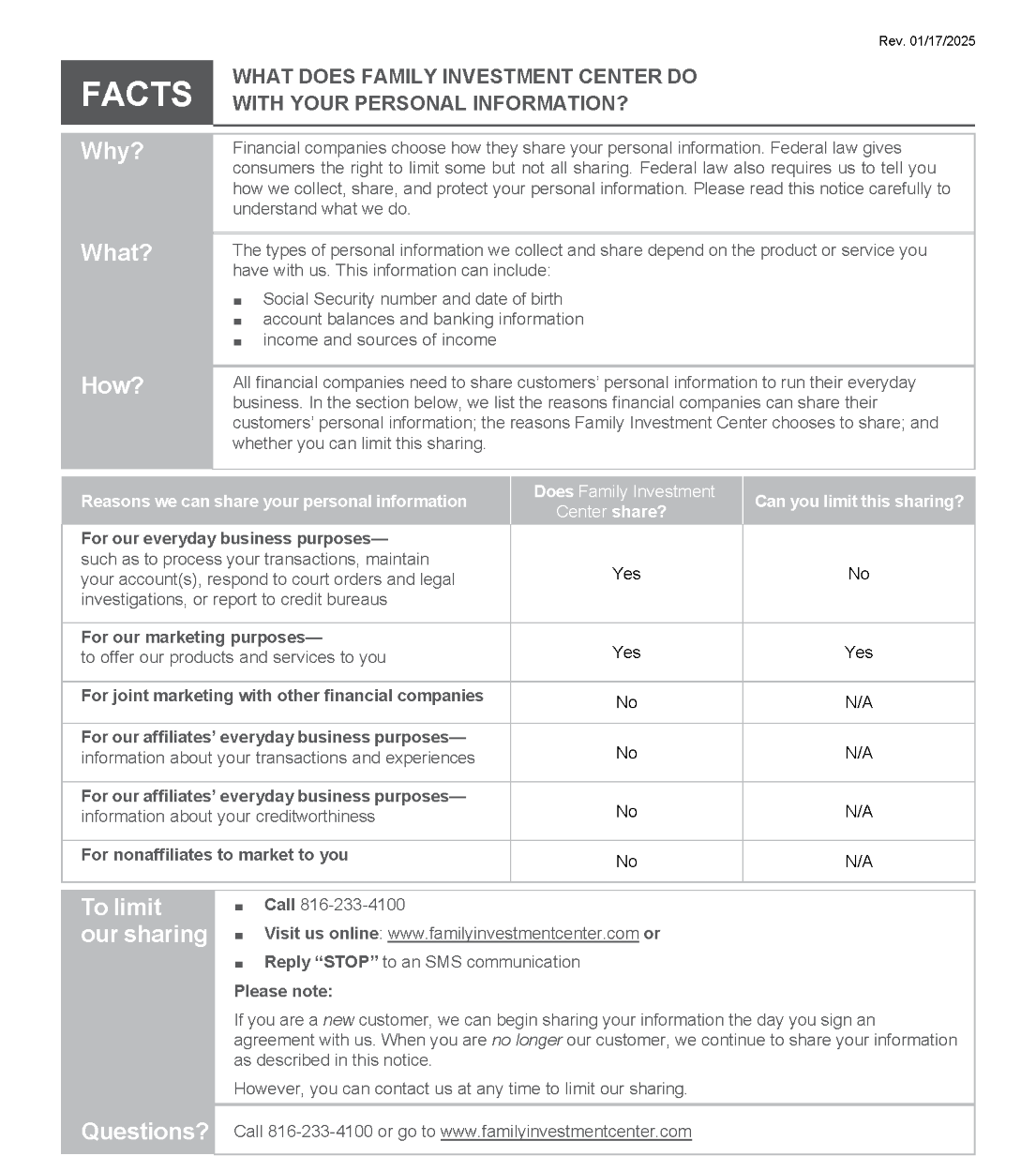

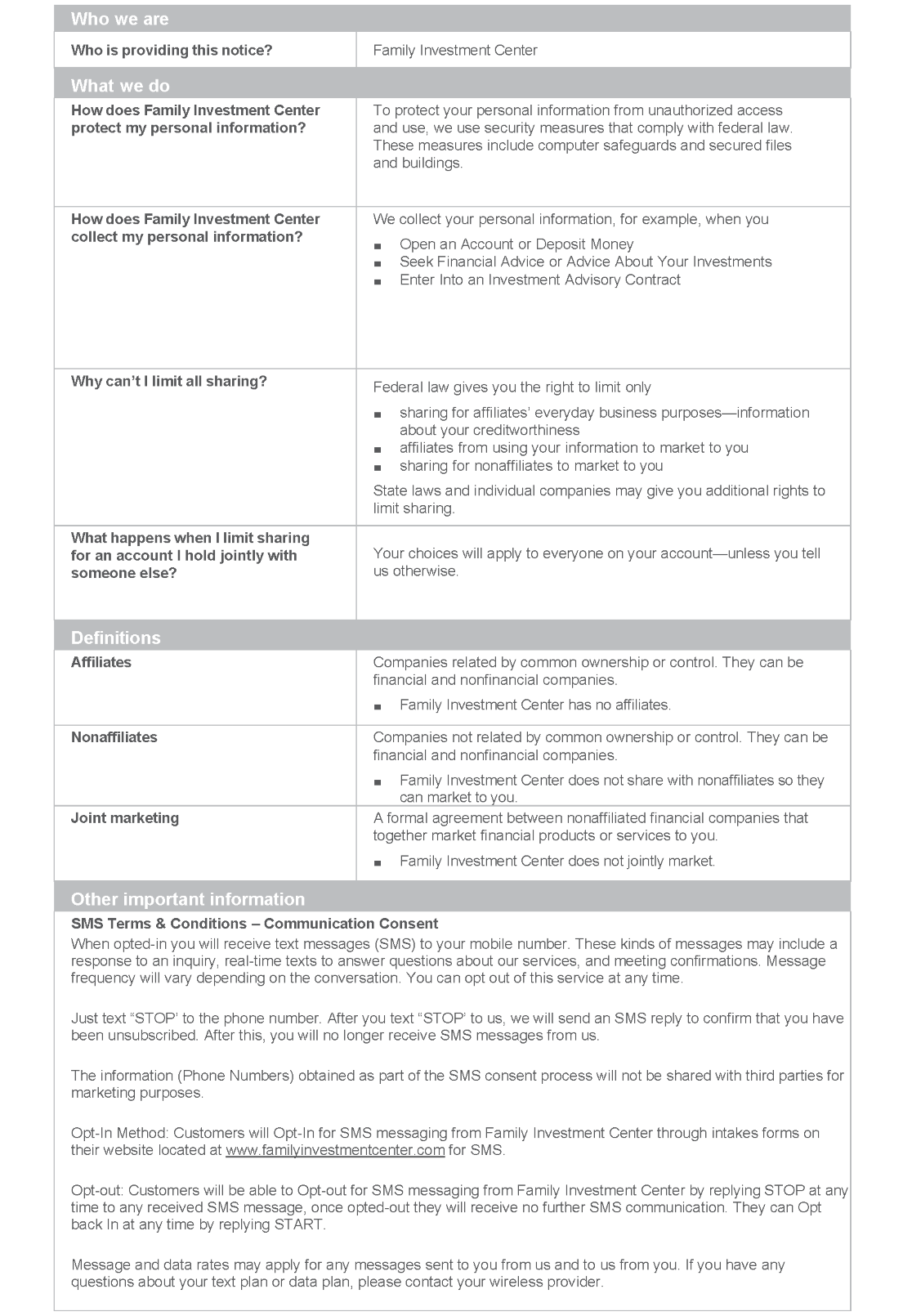

Please call if you have any questions. Your privacy, our professional ethics, and the ability to provide you with quality financial services are especially important to us.

3805 Beck Rd, St Joseph, MO 64506 - 816-233-4100

familyinvestmentcenter.com - ngoodman@familyinvestmentcenter.com

Revised January 2025